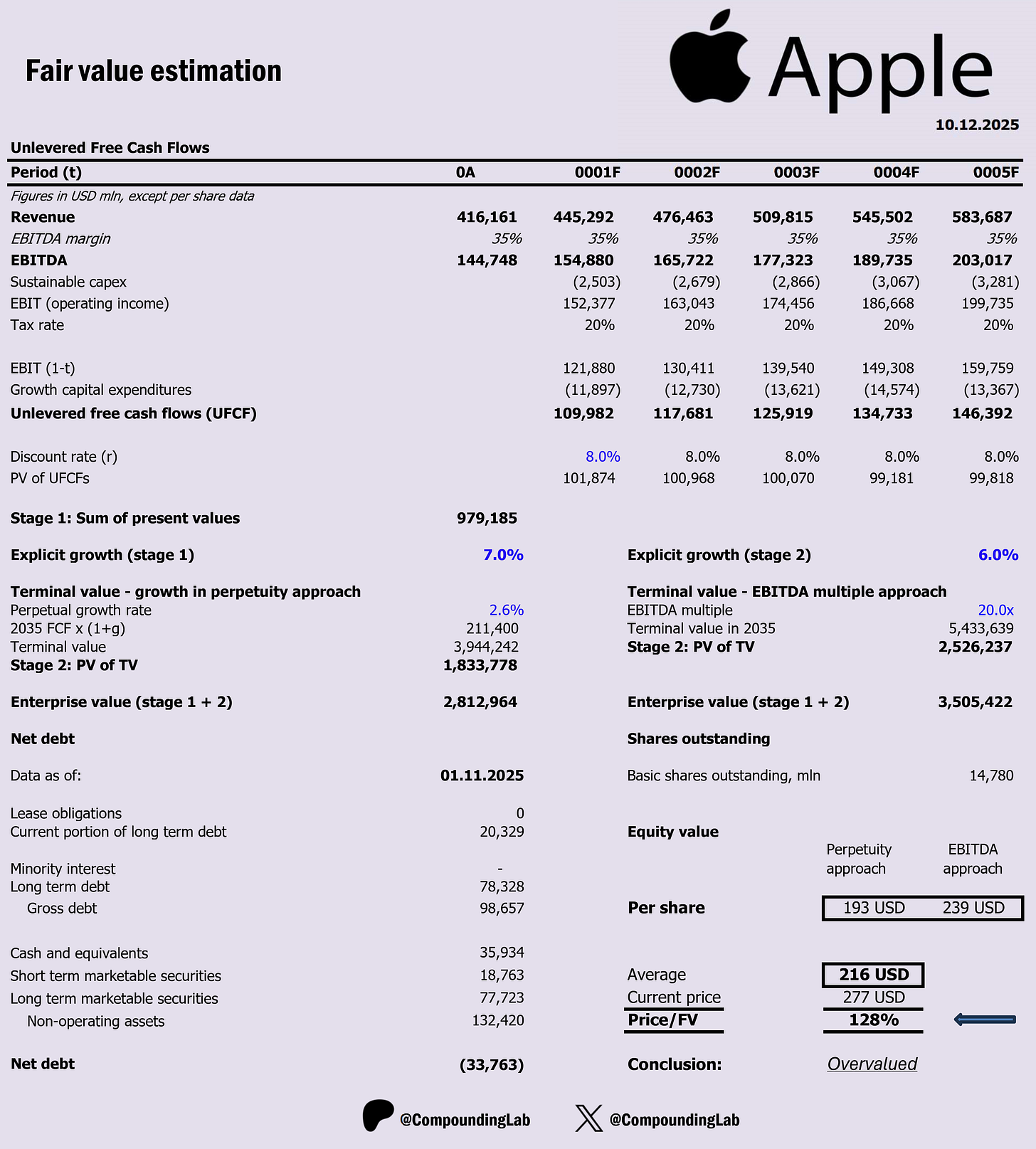

$AAPL DCF valuation

Everyone talks about Apple like it’s a must-own, but our latest DCF valuation tells a different story. At a current price, Apple shares are trading 128% above their fair value.

Are investors chasing hype, or is the market missing something fundamental? Let’s break down the key assumptions and see why Apple might be overvalued.

Key assumptions:

1. Explicit 5Y growth @ 7%

2. Long-term growth in perpetuity @ 2.6%

3. WACC @ 8%

4. An EV/EBITDA exit multiple of 20

5. Reinvestment: The input that drives growth reinvestment is the industry Sales to Capital ratio = 2.62

Over the past several years, Apple has delivered decent, but not impressive top-line growth (6% on a 10Y median basis), driven by strong iPhone sales, services expansion, and ecosystem stickiness. EBITDA margins have remained robust, reflecting operational efficiency, while consistent free cash flow generation has enabled share buybacks and strategic investments. This historic growth provides important context - but as our DCF shows, the market may now be pricing in future growth that’s tougher to achieve.

Conclusion: Shares overvalued.