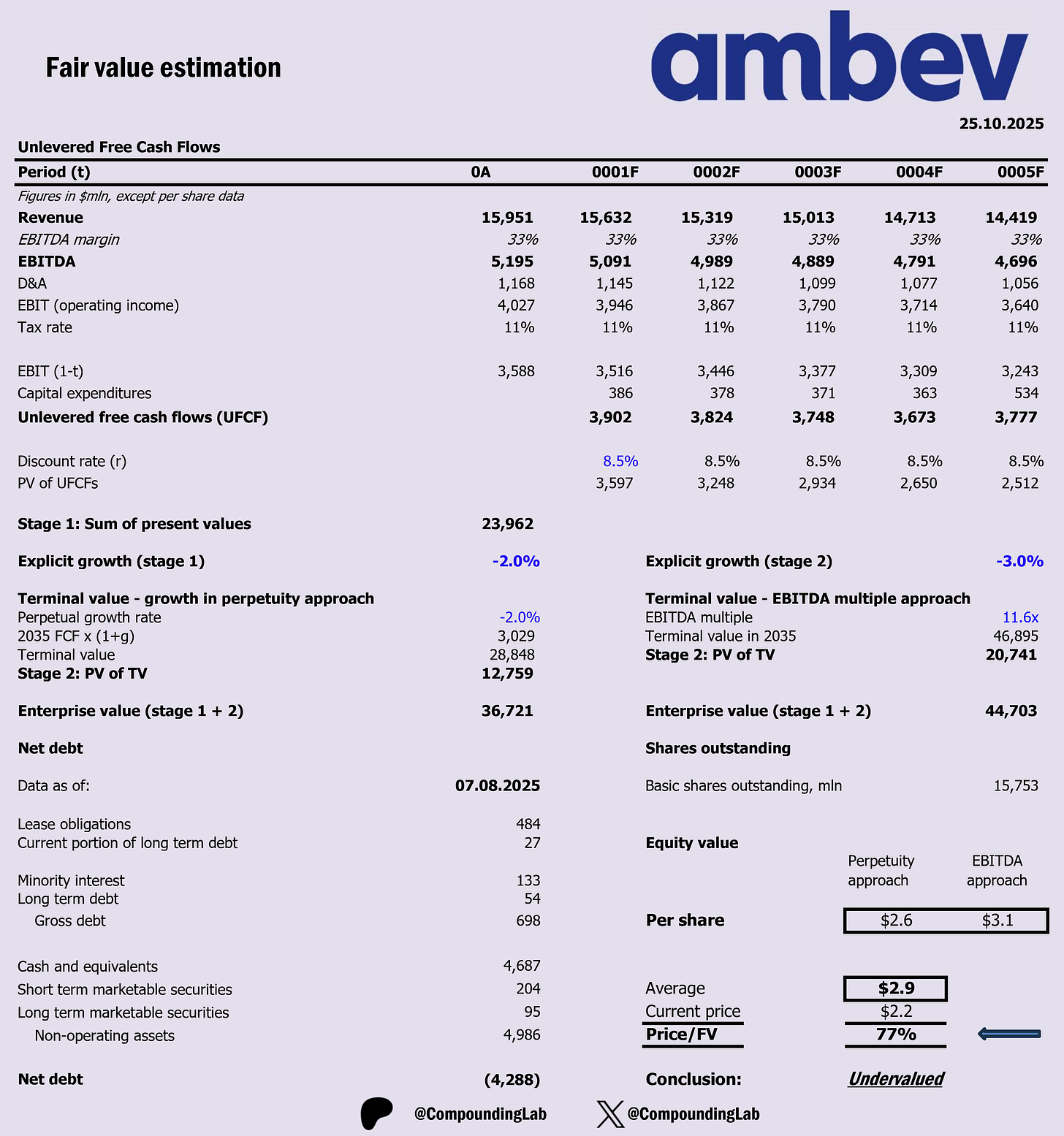

$ABEV DCF valuation model

Valuation suggests that the stock is trading at 23% discount to fair value. If adjusted to FV within 3 years, it will generate annual alpha 9%.

Key assumptions:

1. Explicit 10Y and perpetuity negative growth @ 2-3% (source) in USD terms.

The company has done well in its home currency (BRL) with ~12% growth in 2024, and ~10% long-term CAGR in BRL. In USD terms, picture is much different (because of currency translation) since on a 10Y basis there was a decline in EPS and FCF 2-4%. For valuation purposes, I decided to use USD growth (reflecting international investor perspective).

2. WACC @ 8.5%

3. An EBITDA exit multiple of 11.6 (http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/vebitda.html)

4. Reinvestment: The input that drives reinvestment is the most recent Sales to Capital ratio = 1.1

Why I believe it can work out well

1. Earnings Momentum & Margin Recovery

Cost pressures are easing — barley, aluminum, and fuel costs peaked in 2022–23 and have since declined, helping margins normalize.

Price discipline & premiumization: Ambev has been successful raising prices in Brazil and Latin America South while expanding higher-margin premium brands (e.g., Budweiser, Stella, Corona).

Volume stabilization: Beer consumption rebounded in 2024 after post-pandemic volatility; with Brazil’s economy expanding modestly, per-capita demand could lift volumes.

2. Operating Leverage from Scale

With ~54% of revenues from Brazil and large fixed cost base, any incremental volume growth flows strongly to EBITDA. Latin America South (Argentina, Chile, Paraguay, Uruguay) saw >40% revenue growth in BRL terms in 2024 — continued strength there would provide upside surprise.

3. Currency & Macro Tailwinds

Brazilian real (BRL) has been relatively stable in 2024 compared with prior volatility; if it strengthens vs USD, reported earnings (for ADR holders) improve. Falling Brazilian interest rates (SELIC) improve consumer purchasing power and reduce Ambev’s cost of capital, which supports valuation multiples.

4. Strong Cash Generation & Dividends

Ambev remains highly cash-flow generative with minimal net debt (net cash position) and consistent FCF generation. 10Y standard deviation of FCF is only 22%, which is very low and can rarely be found. This supports the idea that this business is pretty stable and predictable. The company regularly distributes 70–90% of net income as dividends, implying a 5–6% dividend yield even before valuation re-rating — which supports total return.

5. Defensive Qualities in a Volatile Market

Beverage consumption (especially beer and soft drinks) is non-cyclical — resilient during slower growth periods. This makes Ambev a wide moat “quality compounder” within Latin American equities, offering both yield and stability.

6. Management & AB InBev Support

Ambev benefits from AB InBev’s global procurement, technology, and brand ecosystem, allowing competitive advantages in logistics, sourcing, and innovation. Digital transformation initiatives (e.g., BEES platform for retailers) deepen customer relationships and improve channel efficiency.

7. Valuation Re-Rating Potential

At ~$2.2/share, Ambev trades at ~14–15× forward P/E, below historical averages (~17–18×). If margins normalize and growth visibility improves, market may re-rate towards my estimate $2.9 (equivalent to ~18–20×), driving that ~9% annual alpha.

What can go wrong

1. Margin Compression Persists

Input costs could rise again: Barley, aluminum, or energy prices might rebound, especially if geopolitical tensions (e.g., Middle East, Ukraine) flare up.

Price caps or consumer pushback: Inflation fatigue in Brazil and Latin America may limit Ambev’s ability to pass through higher costs.

Mix shift risk: Growth in lower-priced brands or channels (e.g., value beer) could offset premiumization gains.

2. Currency Headwinds (FX Risk)

40% depreciation of BRL over the last 10 years is one of the reasons for negative total shareholder returns when calculated in USD. EPS is also down 6% on average per year. PPP theory suggests that BRL will continue to depreciate, if one considers the current interest rate environment – interest rate in Brazil is 15% vs 4.25% in USA.

3. Macro & Political Risk

Brazil’s fiscal policy, government intervention, or new taxes (especially on alcohol) could hurt margins.

Consumer confidence is still sensitive to inflation and interest rates; even with SELIC cuts, credit remains tight.

Exposure to Argentina (within Latin America South) adds risk — FX controls and high inflation distort reported numbers.

4. Competitive Pressure

Heineken and local craft brewers continue gaining share in Brazil, especially in the premium segment.

Retail consolidation (supermarkets, convenience chains) gives distributors greater bargaining power, pressuring Ambev’s pricing and trade spend.

Ambev’s dominance invites regulatory scrutiny and potential anti-competitive constraints.

5. Weak Volume Growth / Saturated Market

Brazil’s beer market is mature; long-term per capita consumption growth is limited.

Soft drinks segment is declining structurally as consumers shift toward non-sugar beverages and energy drinks.

Demographic stagnation (low population growth) further limits volume upside.

6. Execution & Strategic Risks

Missteps in digital transformation (BEES platform) could lead to higher costs or channel conflict.

Dependence on AB InBev’s broader strategy — if priorities shift at the parent level, Ambev’s capital allocation flexibility could narrow.

Difficulty scaling innovation or new products beyond core beer categories.

7. Governance & Dividend Dependence

Heavy reliance on dividend payouts might cap reinvestment or innovation spending.

Investors expect consistent high payout; any reduction could trigger a valuation de-rating.

As a controlled subsidiary of AB InBev, minority shareholder interests might not always be prioritized.

8. Valuation Traps & Market Sentiment

The stock could stay “cheap” for long periods — Latin American equities often trade at a discount due to macro risk, not fundamentals.

Investors may prefer global beer peers (Heineken, AB InBev) with more geographic diversification.

If global risk appetite shifts away from EM assets, Ambev’s multiple may remain compressed even with solid earnings.

Conclusion: I have been monitoring this stock for several years, and was hesitant to enter the position, mainly due to FX risk. Today, status quo remains the same, despite an attractive discount to FV. Will skip this for now as there are other, more attractive opportunities on the market right now.