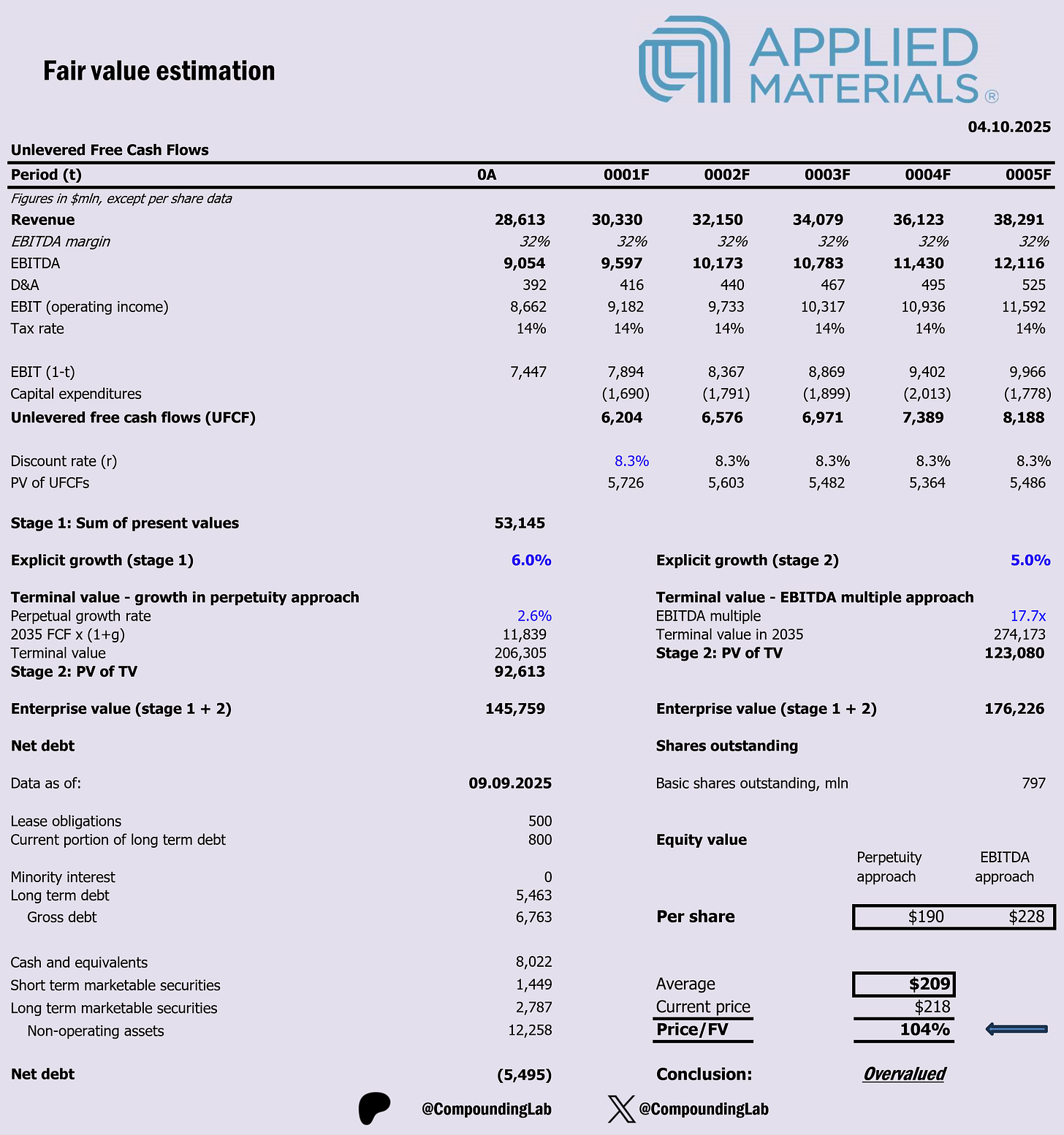

$AMAT - DCF model

Applied Materials Inc

Valuation suggests that the stock is trading at 4% premium to my fair value estimate. No alpha is expected to be generated from this stock.

Key assumptions:

Explicit initial 5Y growth @ 6%, subsequent 5Y-10Y @ 5% (https://seekingalpha.com/article/4824358-applied-materials-valuation-upside-exists-but-im-awaiting-clarity-on-china)

I am using growth rates that are unarguably below the historical average. This is because there is increasing risk and evidence in parts of its business (notably China, certain process tool categories) that AMAT could lose share to local competitors or underperform the broader equipment market.

Long-term growth in perpetuity @ 2.6% (Global economic growth projection https://www.pwc.com/gx/en/world-2050/assets/pwc-the-world-in-2050-full-report-feb-2017.pdf)

WACC @ 8.3%

For relative valuation: an EBITDA exit multiple of 17.7 of the Semiconductor industry (http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/vebitda.html)

Reinvestment: The input that drives reinvestment is the most recent Sales to Capital ratio = 1.1

Why the bull case can work out well

Secular tailwinds from AI and advanced semiconductors

China and localization risk already priced in

Operating leverage & margin expansion

Capital return (buybacks + dividends)

Resilience vs. peers

Upside optionality from new businesses

Multiple re-rating

Better-than-expected WFE cycle

What can go wrong

China dependency & geopolitical risks

Semiconductor capex downturn (WFE cycle risk)

Margin pressure

Technological disruption

Execution risk on new opportunities

Regulatory & tax headwinds

Capital return not enough to support valuation

Multiple compression

Macro shocks

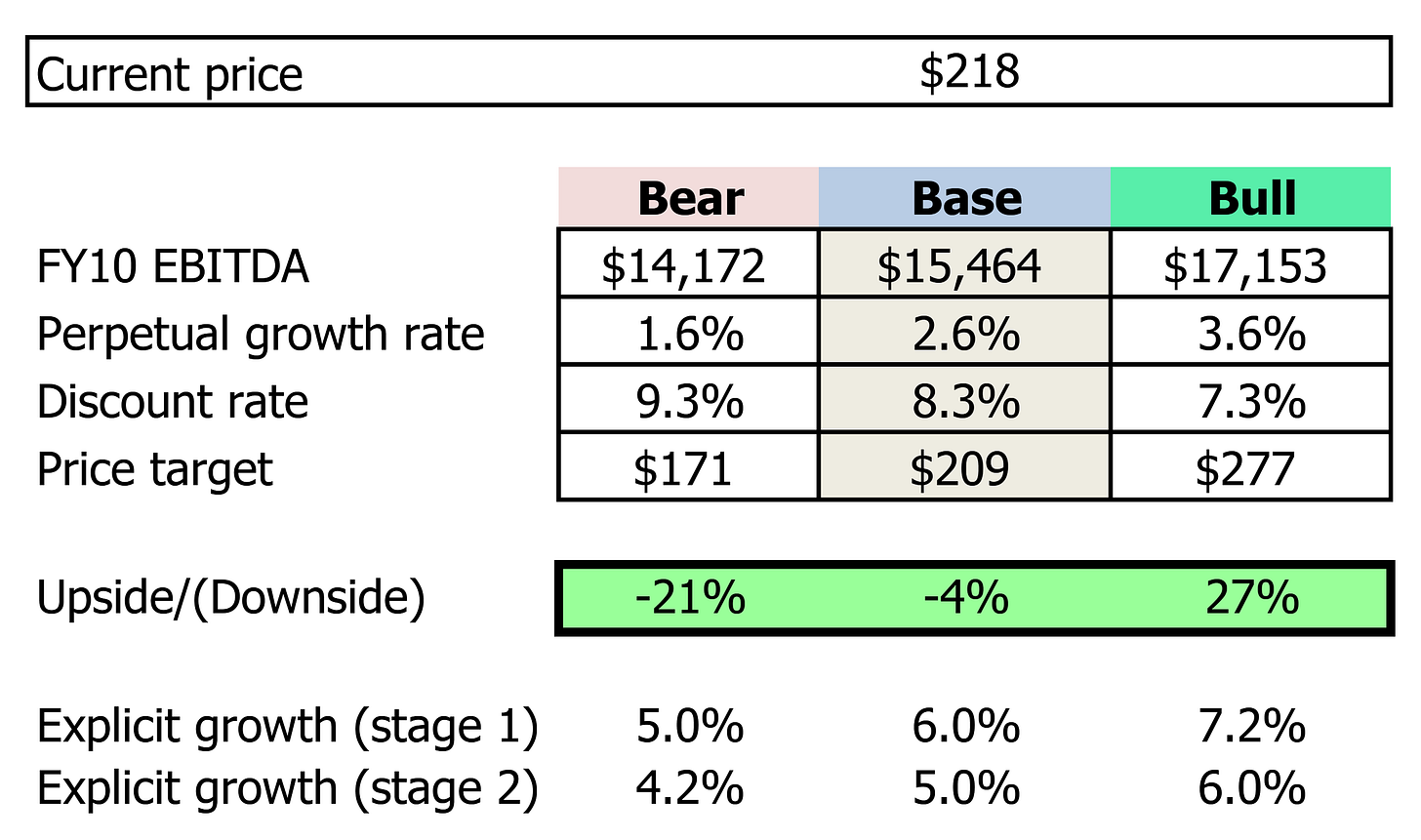

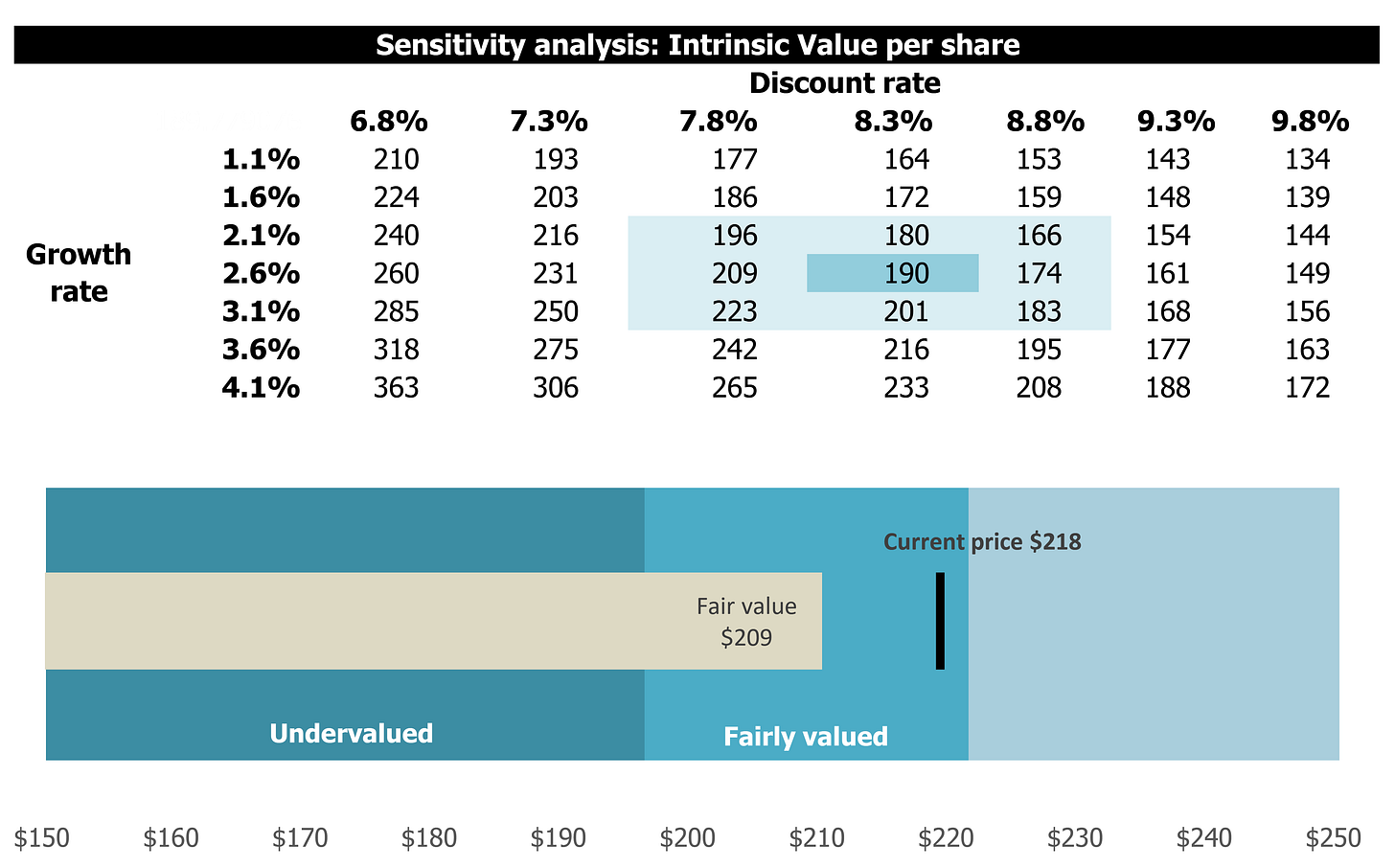

Sensitivity

If you disagree with me on certain aspects, you can choose your own assumptions using the tables below.

Base case + Bear case + Bull case

Sensitivity table

Conclusion: Entry can still be justified, since this is a great company with wide moat, trading at fair value.