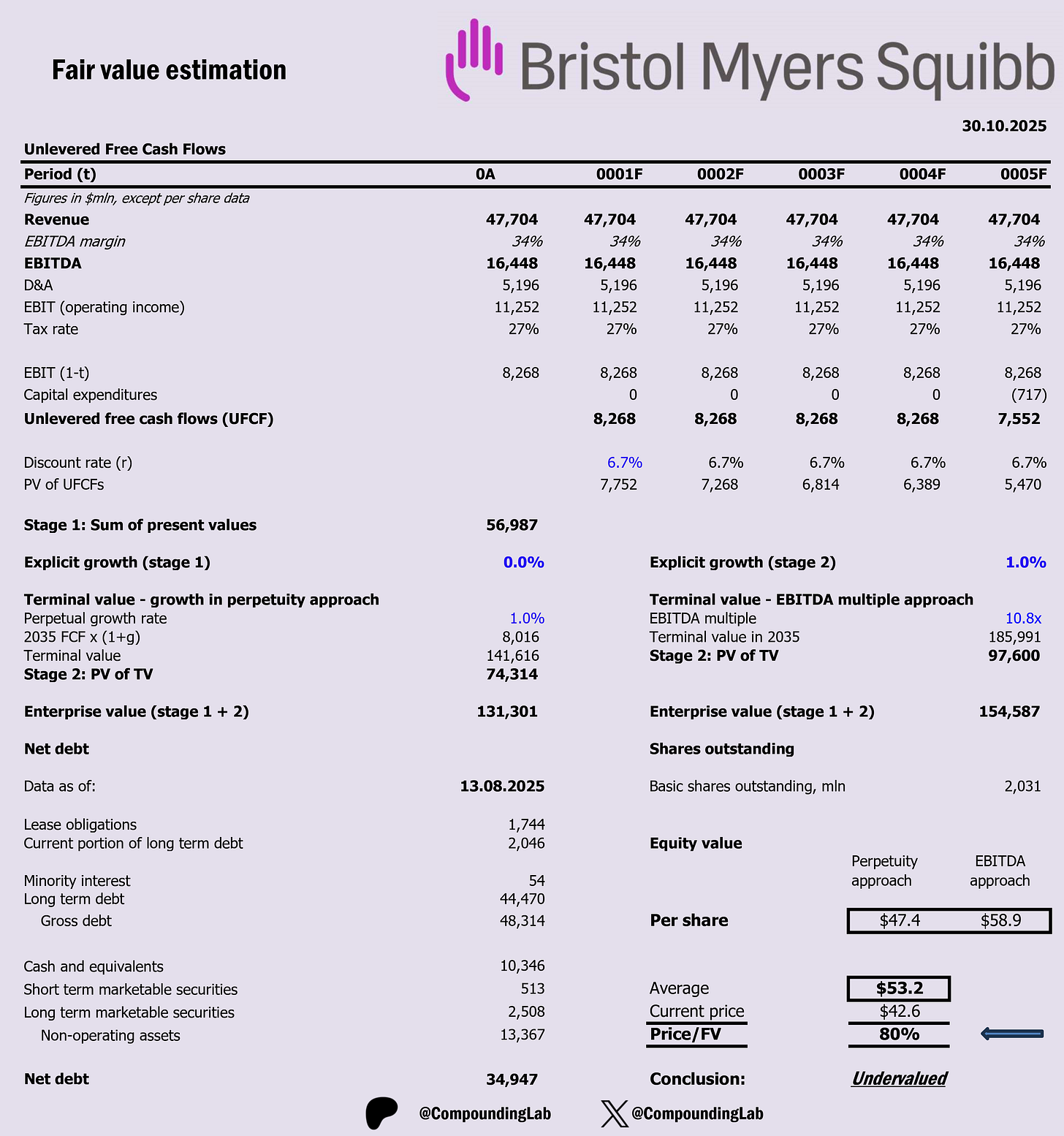

$BMY DCF valuation model

Bristol-Myers Squibb Co

Since I prepared this model, shares were already up following the earnings release.

Nevertheless, happy to share with you my workings for this narrow moat company.

Valuation suggests that the stock is trading at 20% discount to fair value. If adjusted to FV within 3 years, it will generate annual alpha ~ 7%.

Key assumptions:

1. Zero to min growth scenario (https://seekingalpha.com/article/4835627-bristol-myers-squibb-q3-earnings-review-despite-todays-gains-i-see-trouble-ahead)

BMY has shown uneven but generally positive revenue growth over the past decade, driven largely by portfolio evolution and strategic acquisitions. From 2015 to 2018, revenue was relatively stable in the $19–22 billion range as the company streamlined operations following divestitures. The major inflection came in 2020, when revenue jumped to ~$42.5 billion from ~$26.1 billion in 2019, primarily due to the Celgene acquisition, which added blockbuster oncology drugs such as Revlimid and Pomalyst. Since then, growth has normalized, with 2021–2024 revenues hovering around $46–48 billion, reflecting modest organic expansion from core products like Eliquis and Opdivo, partially offset by declining Revlimid sales as generic competition began. Overall, BMY’s historical compound annual growth rate over the last 10 years is roughly 12%, though excluding the Celgene effect, its organic growth trend is closer to the low- to mid-single digits.

2. WACC @ 6.7%

3. An EBITDA exit multiple of 10.8

4. Reinvestment: The input that drives reinvestment is the most recent Sales to Capital ratio

Conclusion: shares slightly undervalued, but I will refrain from entry at this point. A larger discount is required.