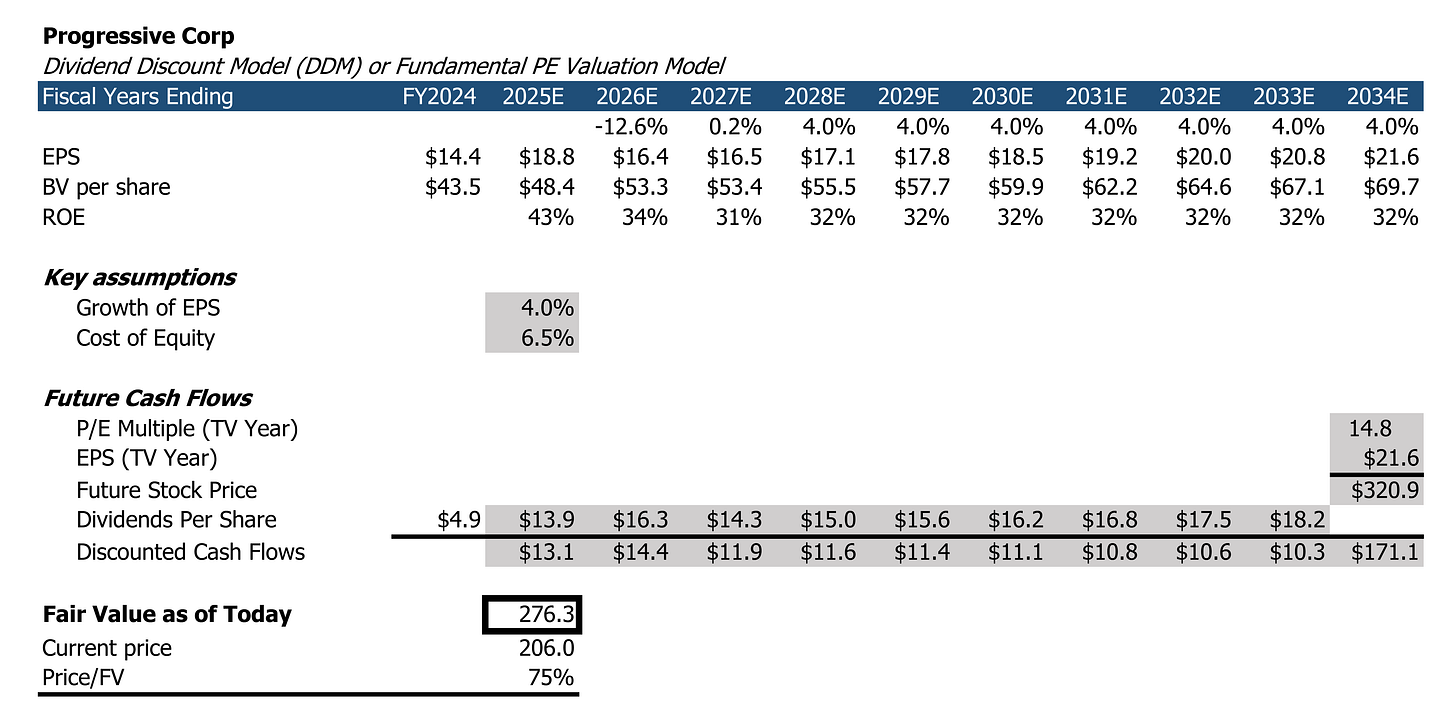

$PGR valuation model

As promised, I’m releasing my $PGR valuation model (DDM with a terminal multiple cross-check).

I spent half a day building the model and stress-testing assumptions.

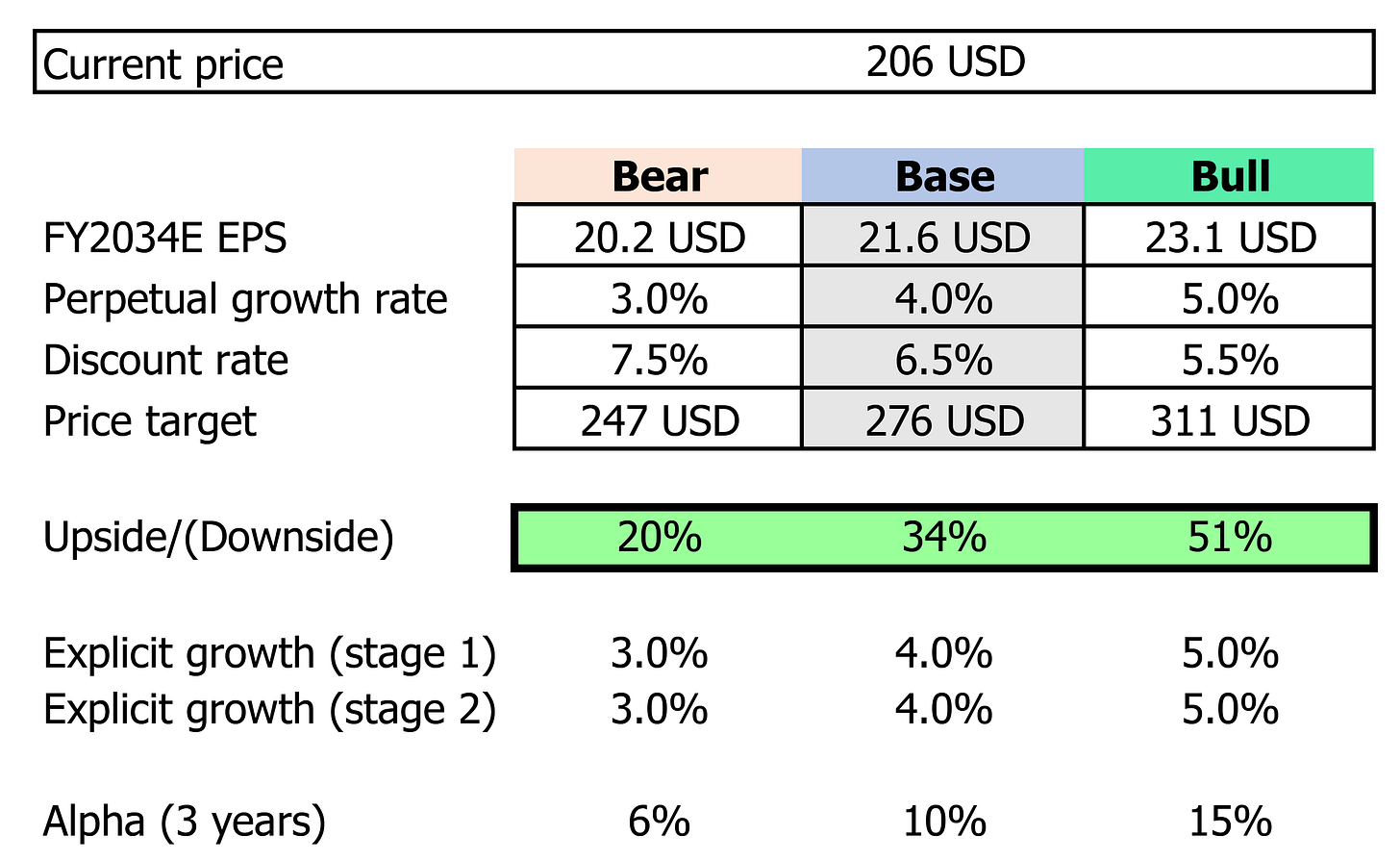

Result: Progressive appears undervalued by 25%. If the stock converges to fair value over the next 3 years, this implies 10% annual alpha.

Key assumptions:

1. Long-term EPS growth: 4%

2. ROE remains structurally high at 32%

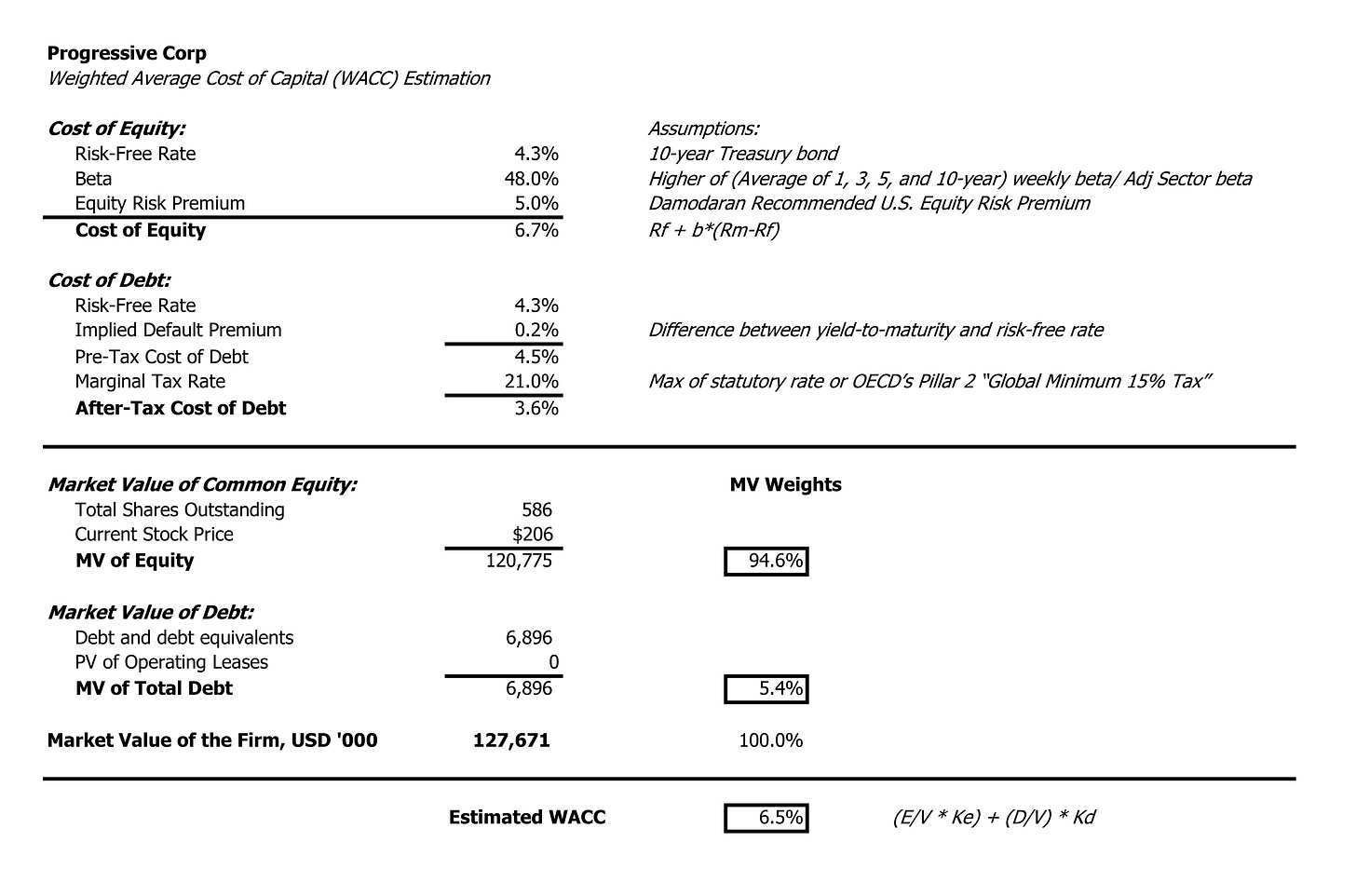

3. Cost of Equity: 6.5%

4. P/E exit multiple: 14.8

Key points:

Progressive has the highest 10Y average ROA among listed P&C insurers (5.68%).

#2 U.S. auto insurer by market share, behind State Farm (private).

Despite a recent EPS miss, long-term growth expectations remain intact.

Core moat: data-driven underwriting and pricing at unmatched scale.

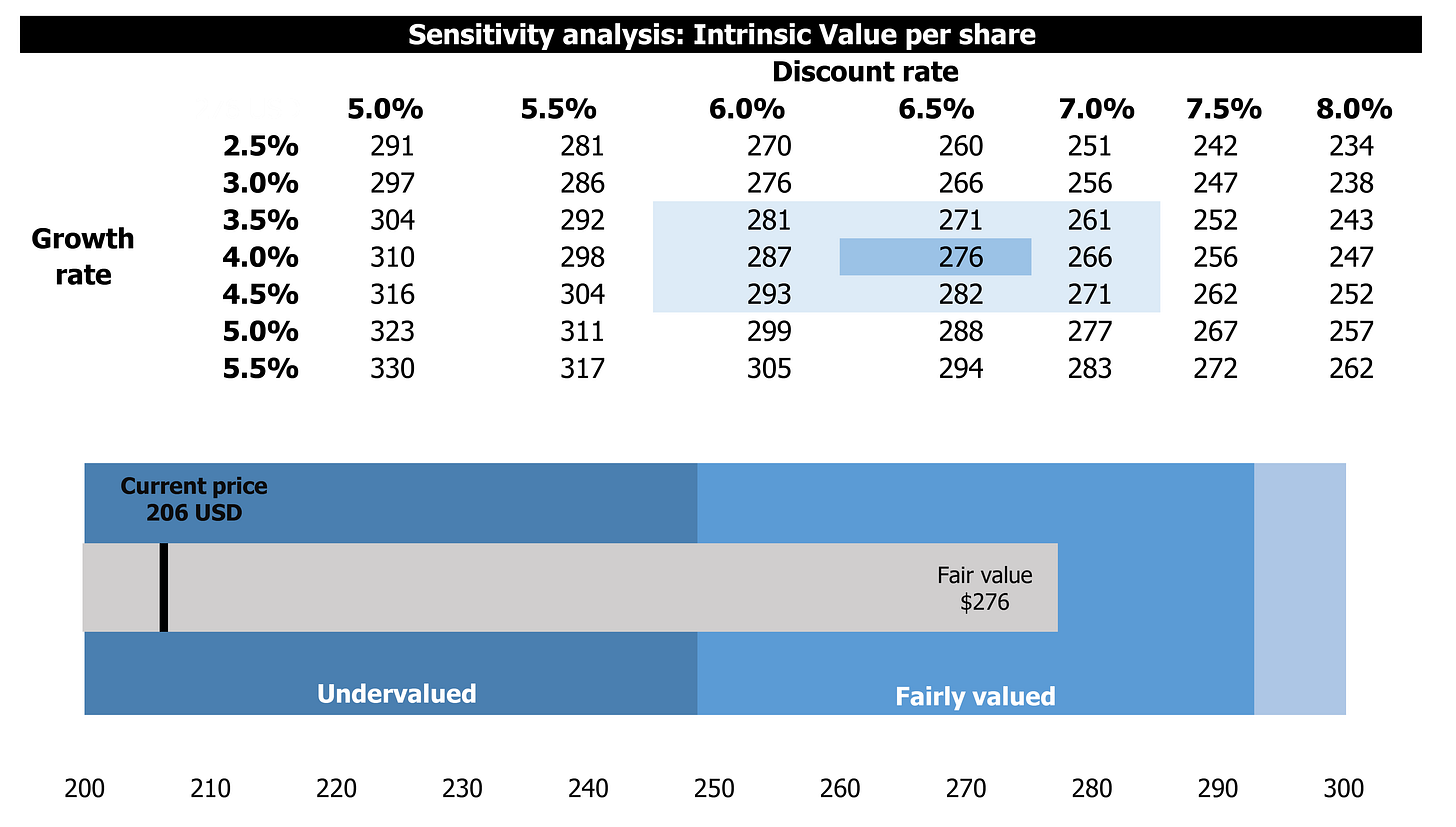

Sensitivity

Across most reasonable scenarios, shares remain undervalued. Even the bear case implies 6% annual alpha, which is rare.

Sensitivity workings:

Conclusion: Progressive looks attractively priced. I’ve initiated a small position and plan to add if weakness continues.

As always, this is an estimate — not a prediction. The model guides my own capital allocation and may help inform yours. If you share it, please credit the source.

Disclaimer: not financial advice. Do your own research.