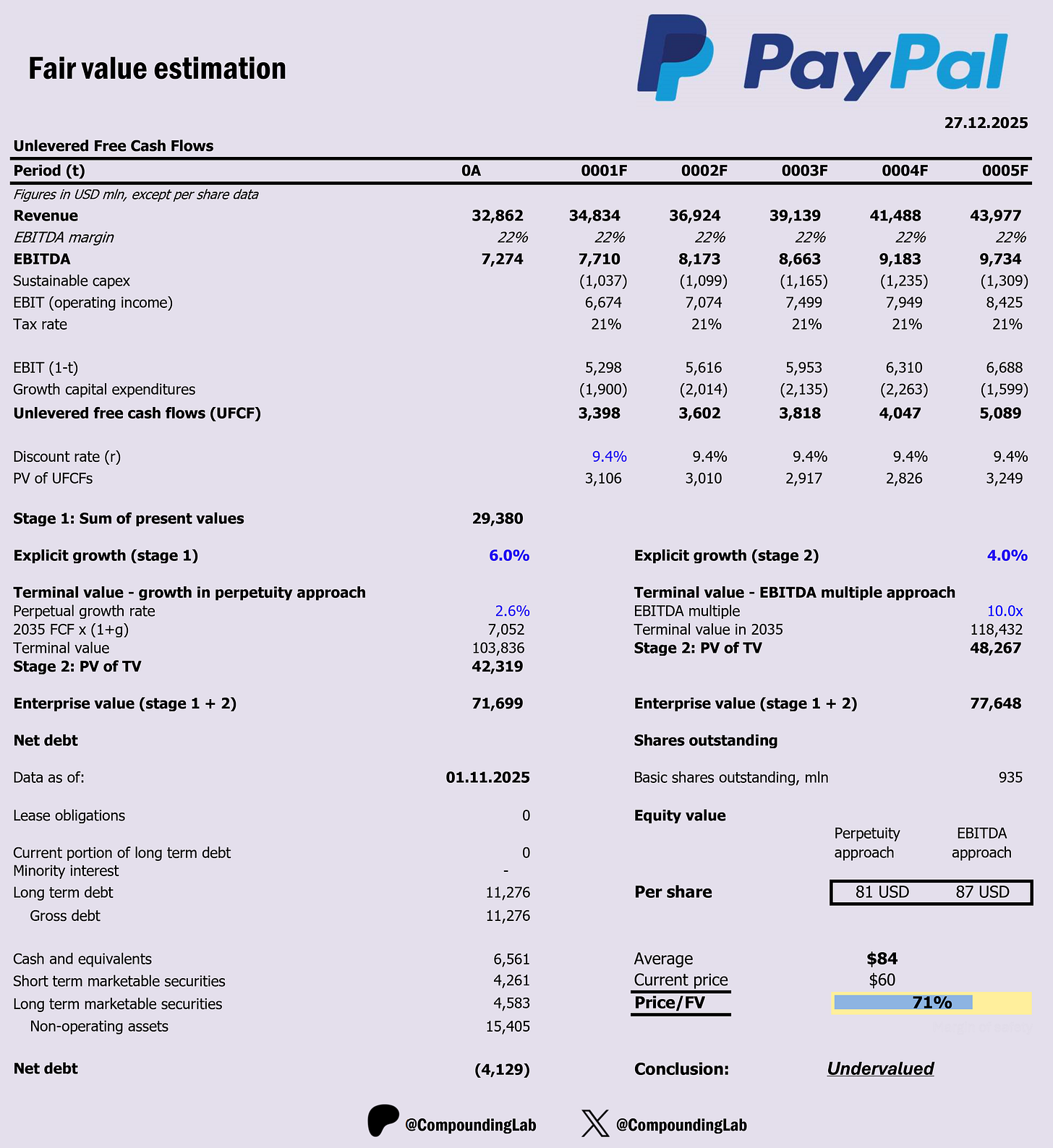

$PYPL valuation

Today I am delighted to share an updated $PYPL DCF valuation model.

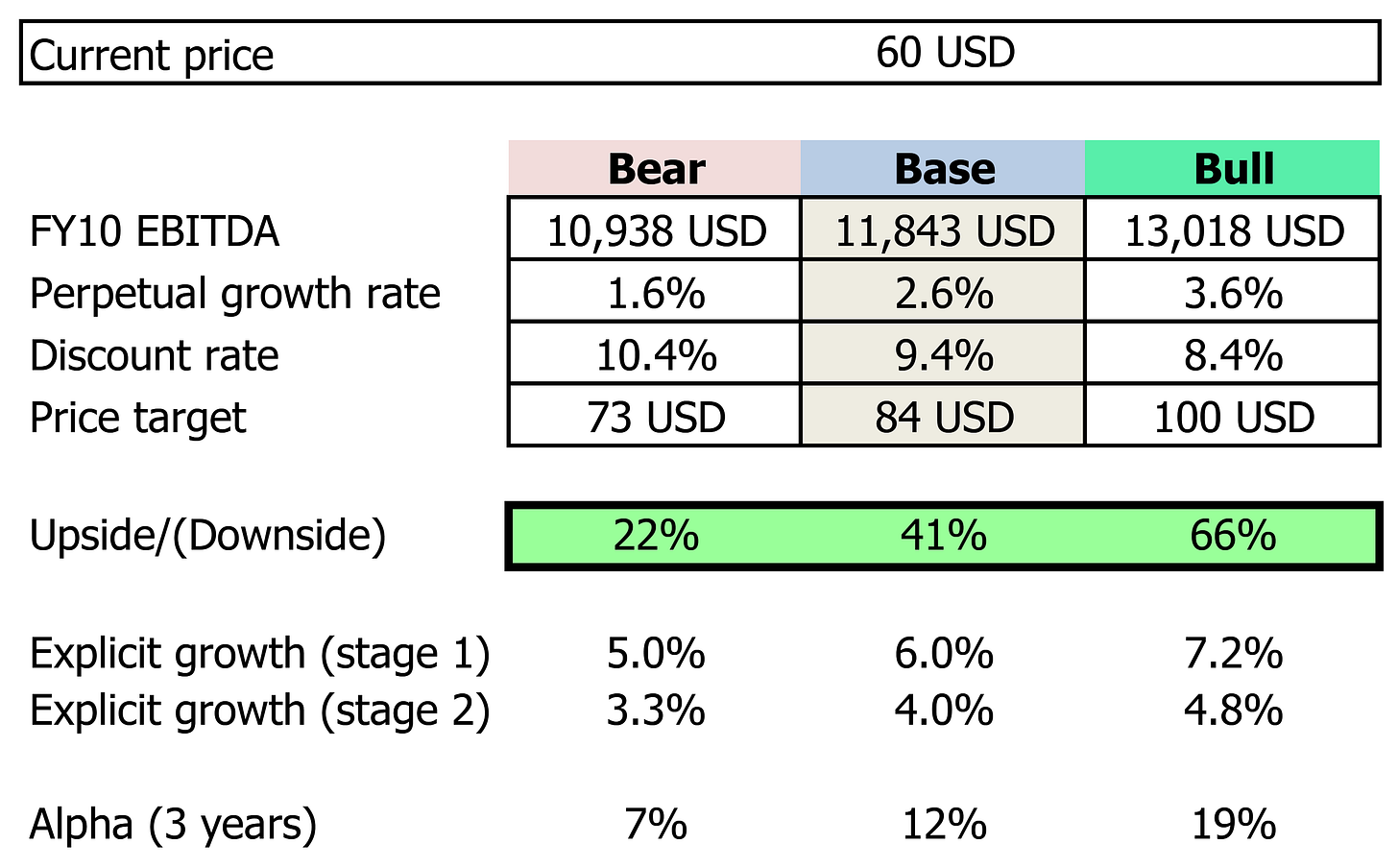

PayPal doesn’t need to be great - just less misunderstood. At a 29% discount to intrinsic value, buybacks + margin normalization can drive ~12% annual alpha as valuation mean-reverts.

Key assumptions:

1. Explicit 10Y growth @ 6-4% (https://about.pypl.com/news-details/2025/PayPal-Introduces-Outlook-for-Accelerating-Growth-at-Investor-Day/default.aspx).

PayPal is pivoting its strategy under CEO Alex Chriss to reignite growth through several key initiatives:

• Fastlane by PayPal: A new one-click guest checkout experience designed to increase conversion rates for merchants. This is seen as a major competitor to Apple Pay and Shopify’s Shop Pay.

• Unbranded Processing (Braintree): While this has lower margins than branded PayPal, it remains a high-volume revenue driver, processing payments for companies like Uber and Airbnb.

• Monetization of Venmo: Improving the take rate on Venmo through debit cards, business profiles, and the “Pay with Venmo” feature at major retailers.

• Expansion into SMBs: The launch of “PayPal Open” aims to consolidate services for small and medium businesses, offering a unified platform for payments, credit, and risk management.

During the 2025 Investor Day, management shared “Longer-term Ambitions” that suggest 10% growth in Transaction Margin Dollars; however, I am taking a conservative view and assuming 6-4% growth within the explicit 10 years. Notable observation – there was not even one year in the prior decade when PayPal revenue declined. Even a high-flying competitor like Block ($XYZ) had a negative 2022, but PYPL did not.

2. Long-term growth in perpetuity @ 2.6% (Global economic growth projection https://www.pwc.com/gx/en/world-2050/assets/pwc-the-world-in-2050-full-report-feb-2017.pdf).

3. WACC @ 9.4%. Implied market return used in calculation is 8.2% (https://edge.sitecorecloud.io/krollllc17bf0-kroll6fee-proda464-0e9b/media/Cost-of-Capital/kroll-uk-erp-rf-table-new-2022-updated.pdf).

4. An EBITDA exit multiple of 10 (http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/vebitda.html) .

5. Tax rate 21% (calculated from 2024 P&L).

6. Reinvestment: The input that drives reinvestment is the most recent Financial Sector Sales to Capital ratio = 1.1.

Bull case

• Strong Free Cash Flow = Self-Correcting Valuation

• Margin Recovery Is Underappreciated

• Growth Doesn’t Need to Be Exciting

• Risk Narrative Is Over-Discounted

• Platform simplification improves UX and conversion

Conclusion: priced attractively enough to maintain a small position (2-3% of portfolio).

Keep in mind that this is an estimate - just like any DCF model. I’m not claiming perfection, but I do trust these calculations to guide my own investments. Hopefully, they can help inform yours as well. If you choose to share it online, please credit my page as the source.